Reacting to Russia

| To view this email as a web page, click here.

What's Happening Today Good morning! It's Kristin with your daily morning digest.

Russia has invaded Ukraine. President Joe Biden pledged to impose more sanctions against Russia for its "aggression," and will meet with G7 leaders today to discuss additional measures. Markets plunged in response, as investors pulled money out of stocks and into bonds, gold, and commodities. Energy markets—particularly oil—have been reacting to the conflict, with oil prices leaping above $100 a barrel, the highest they've been since 2014.

The number of people filing for unemployment for the first time dropped to 232,000 last week, reversing much of the previous week's rise. There are concerns that the latest surge in the omicron variant of COVID-19 will appear in February's jobs report, after January's report showed resilience and strength in the labor market.

And revised economic data shows that the U.S. economy grew slightly more than previously thought, with gross domestic product (GDP) jumping 7% in the last quarter of 2021. An earlier estimate from the Bureau of Economic Analysis had suggested that GDP grew 6.9% in the fourth quarter. Last year was the strongest year for the U.S. economy since 1984, but don't expect that pace to continue in 2022.

- Kristin Editors' Picks

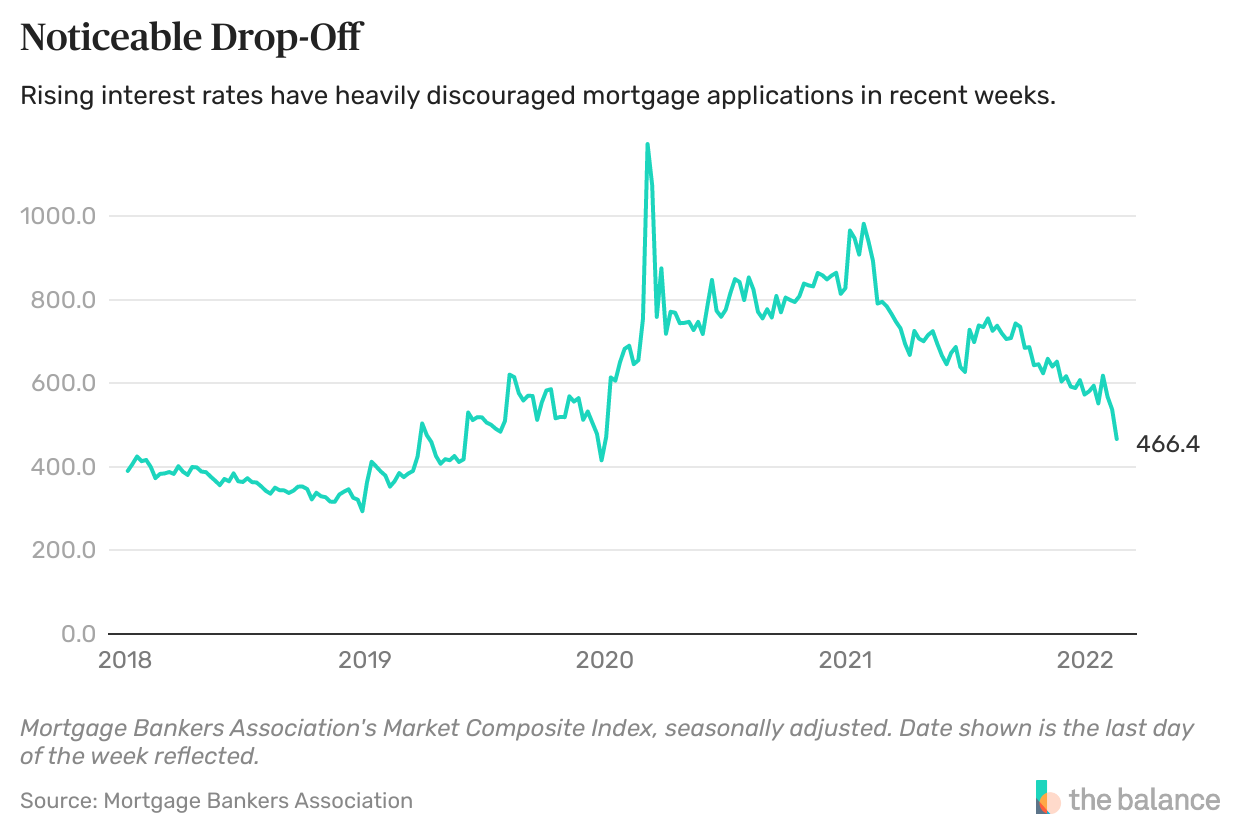

Off the Charts Rising interest rates are discouraging mortgage borrowing, and it's not just refinancing. The volume of overall mortgage applications has fallen sharply, hitting its lowest point since December 2019 last week, according to the Mortgage Bankers Association's index of mortgage activity. Number of the Day $5.36 - That's the average the Tooth Fairy now pays per tooth, according to a newly released poll—a record high since the poll began in 1998.

SPONSORED BY DISCOVER PERSONAL LOANS Debt is one of the biggest financial challenges Americans face. Find out what you can do to reduce debt and take charge of your finances. LEARN MORE >

More From The Balance Before investing in any country, it's important to have a firm grasp of its economy, demographics, government, and political situation. The IRS provides multiple tax breaks for taxpayers age 65 and older, from additional standard deductions to a tax credit just for older adults, all so seniors can save. The Graham Number is a way to find the upper limit of what you should pay for a stock. Learn more about how to find the Graham Number and use it in your investing.

Season 2 of the "Money Confidential" podcast is back with "Taxes in Ten," a six-episode mini-season covering your top tax questions. Host and nationally recognized money expert, Stefanie O'Connell Rodriguez, is teaming up with The Balance's very own Editor-in-Chief, Kristin Myers, as well as Caleb Silver, Editor-in-Chief of Investopedia, to talk about everything from doing your own taxes to the specific tax considerations of different life stages. You can listen to "Taxes in Ten" now, with new episodes airing every Monday. Listen now!

How can we improve The Balance Today newsletter? Tell us at newsletters@thebalance.com.

Email sent to: spiritofpray.satu@blogger.com

|

/GettyImages-150792949-5bddcef946e0fb0051bda5e3.jpg)

/sb10063468bc-001-F-57a631b43df78cf459194909.jpg)

0 Response to "Reacting to Russia"

Post a Comment