Raising Bets

| To view this email as a web page, click here.

What's Happening Today Happy Friday! It's Kristin with your daily morning digest.

Stocks are mixed after falling yesterday on the heels of the latest inflation figures. Prices rose faster than expected (7.5% since last year), bolstering the case for the Federal Reserve to raise interest rates.

St. Louis Fed President James Bullard said in an interview yesterday that his views have become "more hawkish" after the release, and that he's considering three rate hikes, including raising rates by half a percentage point (or 50 basis points) next month. When members of the Federal Reserve are "hawkish," it means that they support raising interest rates, to keep inflation in check. It's the opposite of "dovish," which is when members of the Fed prefer to lower rates.

Traders are already raising bets on it, and researchers at Goldman Sachs are bumping up their prediction from five to seven rate hikes this year. However, other members of the central bank aren't so sure, with San Francisco Fed President Mary Daly indicating she doesn't think the Fed should raise rates that much right off the bat in March.

In the bond market, the latest inflation figures caused volatility, with the yield on the 10-year Treasury note falling after surging past 2% yesterday, its highest since 2019.

Mark your calendar for our next Instagram Live conversation in our Black History Month series. On Tuesday, Feb. 15, at 6 p.m. Eastern, The Balance will chat with Matthew Garland, CEO of Garland Mortgage Group, about what to expect during the homebuying process.

- Kristin Editors' Picks

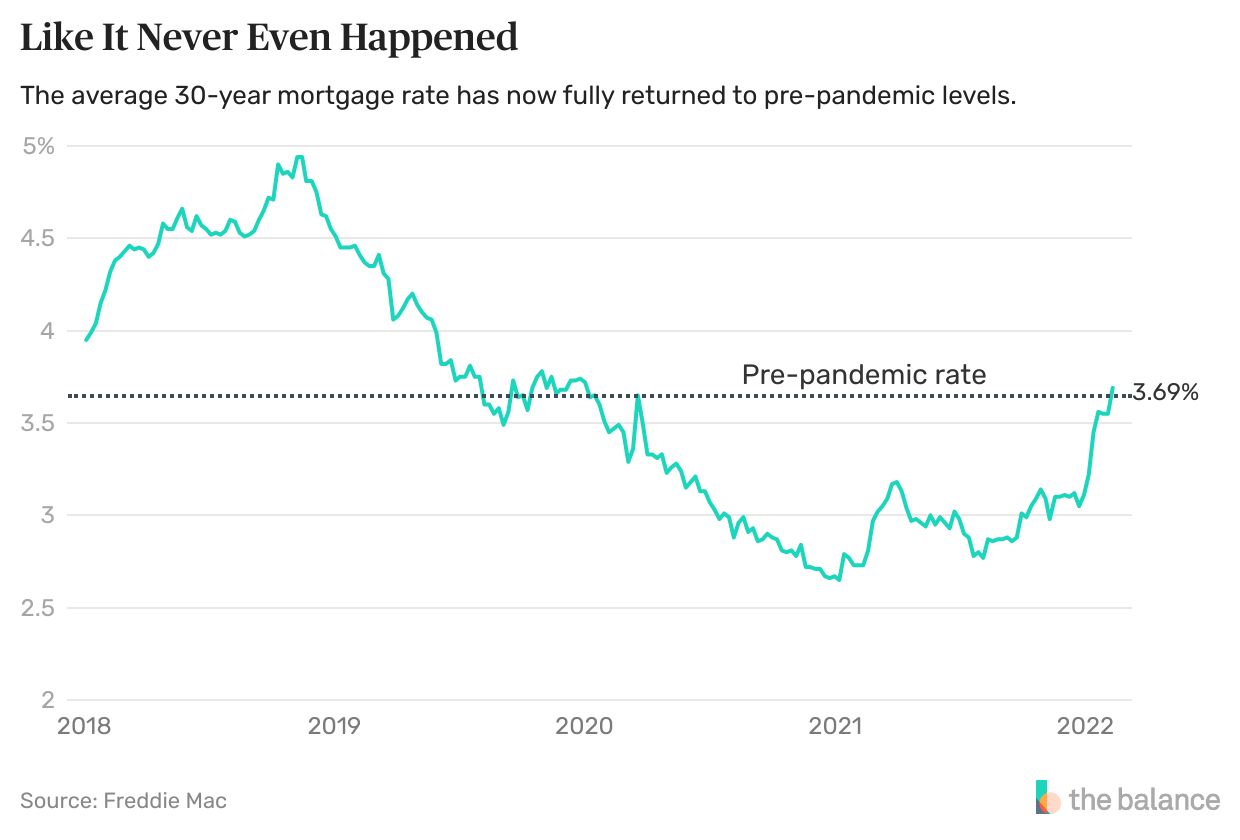

Off the Charts It was nice while it lasted, but the decline in mortgage rates that accompanied the pandemic has now been completely erased, by one measure.

The average 30-year fixed mortgage rate, as measured by Freddie Mac, reached 3.69% this week, surpassing its pre-COVID-19 reading for the first time. As the chart below shows, the pandemic-era dip is over after the recent sharp uptick. Number of the Day 0% - That's how much prices for new vehicles rose in January, a distinct break from months of sharp increases and a sign that car shoppers may start to see some relief.

SPONSORED BY DISCOVER PERSONAL LOANS Debt is one of the biggest financial challenges Americans face. Find out what you can do to reduce debt and take charge of your finances. LEARN MORE >

More From The Balance Prices just keep rising, and if you're not an economist, you may need a translator for all the jargon. Here's what the key inflation terms mean. The economic man theory is the idea that people make decisions based only on self-interest. Learn what economic man theory is and how it works. Bitcoin (BTC) and Ethereum (ETH) both use blockchain technology, but the two cryptocurrencies have important differences. Learn more about BTC vs. ETH here. Follow The Balance on Instagram to join this discussion and receive IG live alerts!

How can we improve The Balance Today newsletter? Tell us at newsletters@thebalance.com.

Email sent to: spiritofpray.satu@blogger.com

|

/Motherandsonshoppingatsupermarket-be0b69aa4871493e9a2d4e23691f5f40.jpg)

0 Response to "Raising Bets"

Post a Comment