Pumped Home Prices

| To view this email as a web page, click here.

What's Happening Today Good morning! It's Kristin with your daily morning digest.

The S&P 500 is falling again this morning, after slipping into correction territory yesterday (that's when stocks slide more than 10% from their most recent high). Investors have been moving money from stocks to traditional safe havens in the face of rising inflation, impending interest rate hikes, and geopolitical tensions between Russia and Ukraine. Today, Ukraine moved to declare a 30-day state of emergency in response to Russian advances along its borders.

If you've taken a peek at retirement or other investment portfolios that have taken a hit recently, don't panic. Corrections are normal and regular occurrences in the market. In fact, research from financial services provider Charles Schwab shows that between 1974 and the onset of the COVID-19 pandemic, the S&P 500 had risen an average of more than 8% the month after a market correction, and more than 24% one year later.

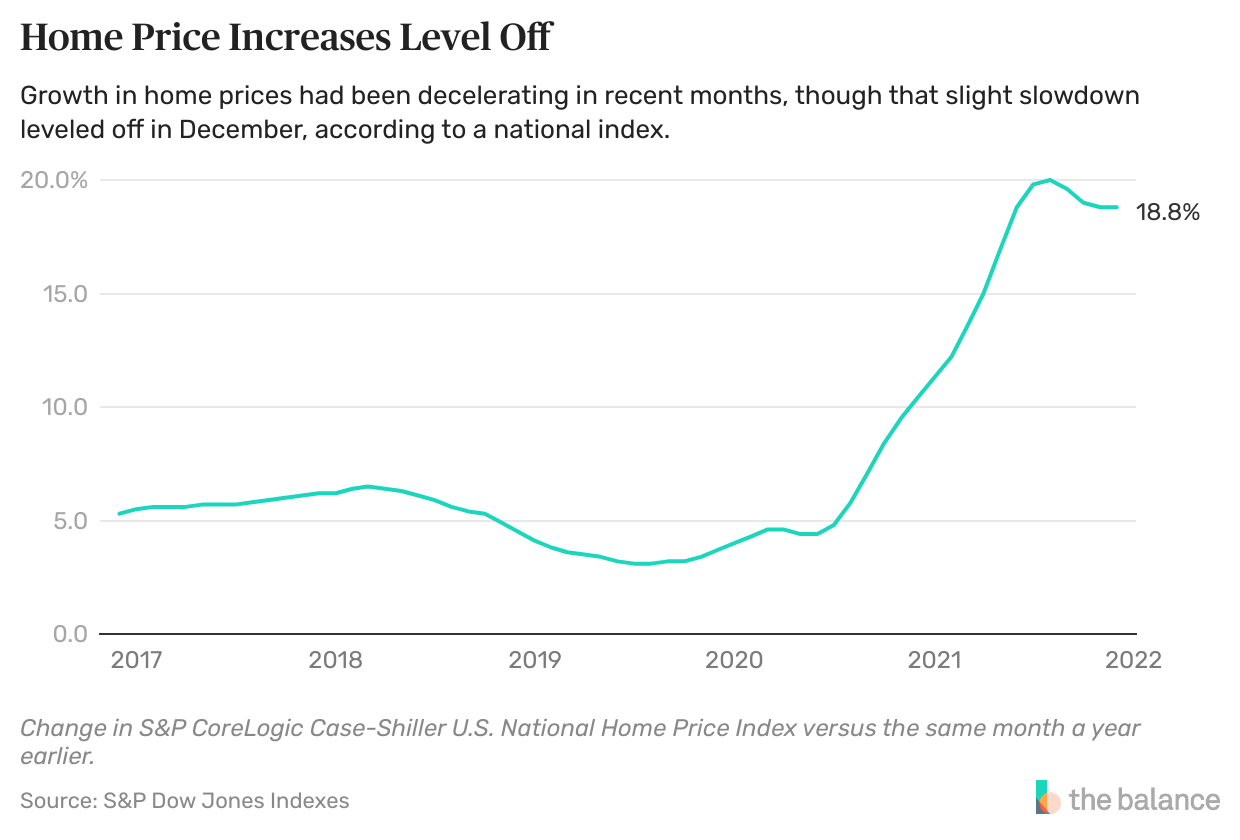

Here at home, home prices jumped 18.8% last year, the biggest increase in 34 years, according to the latest S&P CoreLogic Case-Shiller National Home Price Index. Mortgage rates have also been rising, which isn't helping affordability (though they have retreated from their most recent jumps). As mortgage rates continue to increase, many believe that home prices will start to decline.

- Kristin Editors' Picks

Off the Charts The S&P CoreLogic Case-Shiller Home Price Index showed home prices rose a seasonally adjusted 1.3% in December, bringing them to 18.8% higher than a year earlier. With the year now in the books, 2021 officially saw the fastest home price growth since at least 1988 when the index began collecting data, and it's not even close to the previous record of 13.6%, which was set in 2004. Number of the Day 0.4 Percentage Point - That's how much the inflation rate would increase for every $10 rise in the cost of a barrel of oil, according to estimates by economists.

SPONSORED BY BASK BANK Growing your savings requires a careful strategy and the right savings account. These tips can help you make your money go farther. LEARN MORE >

More From The Balance Setting up a Roth IRA is one of the best ways to save money for retirement. Knowing the rules can help you make the most of these accounts. Dual listing occurs when a company's stock is traded on two or more exchanges, primarily to increase capital by offering the security to more investors. Tracking and understanding OpEx and CapEx is important to keep the company functional. Keep reading to learn what they are and how they can benefit your business.

How can we improve The Balance Today newsletter? Tell us at newsletters@thebalance.com.

Email sent to: spiritofpray.satu@blogger.com

|

0 Response to "Pumped Home Prices"

Post a Comment